Retirement Preparation With Property

Retirement Preparation With Property

Blog Article

A lot of the attention to retirement planning lately has actually been invested on preparing men for retirement. That's a crock since women are going to live longer than men. And still have the remainder of the retirement savings, what remains of it anyhow, to utilize for the rest of their years.

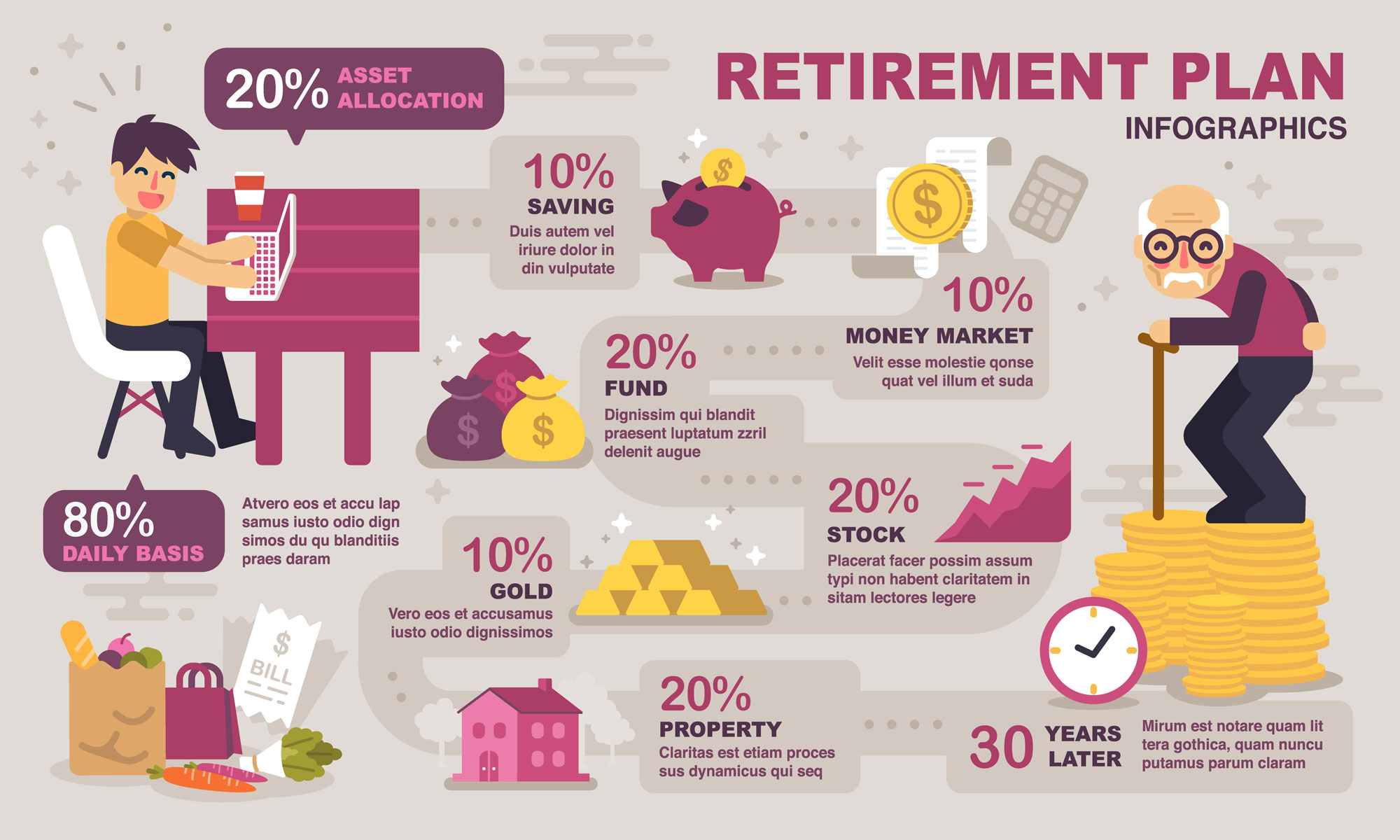

Individual retirement account is an account you can establish in a bank, an insurer or any safe banks. The objective is to transfer a part of your earnings in this account in a routine basis. The money in the account is of course not going to lie there awaiting you to retire. This cash is going to be invested on different things such as genuine estate, stock certificates etc.

An Individual Pension, or employer equivalent, an ISA or possibly less so home are arguably the most popular types of retirement arrangement. How much you put towards these during your working life, once again, completely depends upon how much you want to get out at the other end.

There are lots of locations that will assist you find out what you will need to do initially for your retirement. They will know about all the retirement planning tricks that you require to get you on your way. There is a lot to find out and with some helpful techniques about where to invest and how to put your cash you will be well on your way to collecting some great money towards your retirement fund.

Required obligatory retirement ages do not work. The solution is either to extend your career or have a second career. Due to the unpredictability of the future, living longer and low investment returns the majority of people will have to work longer. For many individuals this may be a preferred option as apart from the health and longevity benefits what will one do with great deals of time but no money?

Sequence Of Returns - If you're far from retirement, the sequence of your portfolio returns are not as essential. They play a much larger role if you're within 5 years of retirement.

Rate of interest are being manipulated by devious political leaders. Today they are so low that it takes a large quantity of money to create an affordable retirement income. If you have $1 million saved, and you make interest of 2 percent you'll earn $20,000 every year. Enough to finance only an economical retirement.

This is the most advantageous element of the investment. The downside of the scheme is that there is a lock in duration. You may not be able to use the cash when you require it may be more than retirement education at the aging.